If you’re planning to utilize the benefits of a Qualified Opportunity Zone (QOZ), you must invest your gain into a Qualified Opportunity Fund (QOF). They are fairly simple to create, but be cognizant of the tests to stay certified and the deadlines for avoiding penalties. Read on to learn more about how, when, and why to set up your QOF.

(Related post: Basics Of Qualified Opportunity Zones)

What is a Qualified Opportunity Fund (QOF)?

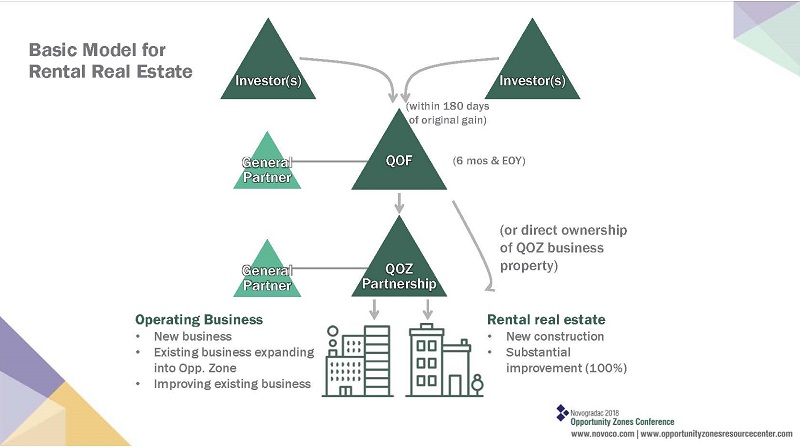

The QOF entity must be a partnership or a corporation, but the taxpayer creating it may be (or the subsidiaries) may be individuals, C corporations, S corporations, REITS, partnerships, estates, trusts, and other pass-through entities. Partners invest cash from the sale of a previously owned asset into the QOF. The list of acceptable gains is below.

Eligible gains for QOF

- Must be capital gains.

- Can’t be ordinary gains from inventory property.

- Can’t be ordinary in character – such as 1245 depreciation recapture.

- Can be short-term holding period – subsequent recognition in future year maintains character.

- Can’t be from a sale to a related party (using 20% instead of 50% definitions).

(See a recording of our live seminar on this topic)

How to create a Qualified Opportunity Fund

Designating an entity as a QOF is straightforward. The fund self certifies by filing a Form 8996 with the initial year tax return and all relevant subsequent years to indicate compliance with statutory requirements.

After certification, there are qualifications it must meet to maintain status as a QOF. While most requirements are related to the timeline of purchase and improvements, there is one test on the fund itself. All QOFs must hold 90% of assets (including business property, stock in another QOF, or partnership interest in another QOF) in the geography defined by the Qualified Opportunity Zones.

There are exceptions to this rule:

- The fund may occasionally fall below the 90% outside the specified testing dates.

- Subsidiaries within QOFs are only required to hold 70% of its assets in QOZ.

For example, if the QOF owns interest in qualified stock or a qualified partnership interest subsidiary, then the subsidiary is only required to own 70% of its assets in QOZ business property. Passing the 70% test allows the fund to treat the entire value of the subsidiary interest as qualified property for purposes of meeting the 90% test.

QOF Testing Periods

There are two annual testing dates for QOFs in which it must have 90% of the assets in QOZ. The first is six months after creation and the second is always on December 31st. The selection of the date of initial qualification of the fund provides planning opportunities.

Failing the 90% test does not automatically disqualify the fund and tax-deferred gain. Instead, it incurs a 5% penalty. We do anticipate some QOFs being unable to reinvest in QOZ assets by the first testing date. Although regulations don’t include cash towards meeting the 90% test, there is a Working Capital Safe Harbor exception for the first 31 months if you have a written plan in place for reinvestment.

If you have further questions regarding Qualified Opportunity Zones or Funds, call the office or email info@whhcpas.com . Check back on our blog for updates and clarifications as we receive new regulations.

By: Ben Hubbell

By: Ben Hubbell