(Updated August 20, 2019)

If you’re considering investing in a Qualified Opportunity Zone, you need to understand what the IRS considers to be “eligible improvements.” Some, but not all, necessary guidance has been issued about the types of property, businesses, and improvements that do and don’t qualify for this great incentive. We will continue to update this post as updates and details are released.

The purpose of Qualified Opportunity Zones is to incentivize investors into improving blighted areas (read more about that in our QOZ Overview blog here). We think these regulations will achieve this purpose while offering a huge value to investors. The benefit of tax deferral on the initial gain is a good benefit on its own, however, the exceptional value (and the reason to be interested in this tax-saving vehicle) is in the tax-free appreciation.

Simply put, you are required to improve a property in a QOZ so that its value at least doubles. Then, once the property has appreciated significantly, the gain on that appreciation is permanently tax-free. Considering the cash that’s required to make these kinds of improvements, it’s imperative to know what counts and what doesn’t in advance. In other words, which are considered eligible improvements.

List of Eligible Improvements for QOZs:

(This list is not all-inclusive.)

- Real property

- Personal property

- Residential rental property

- Commercial rental property

- Farming property

- Manufacturing

- Industrial

- Professional services

Certain businesses are excluded from Qualified Opportunity Zones:

- Golf course or country club

- Massage parlor

- Hot tub facility

- Suntan facility

- Racetrack or other gambling facilities

- Liquor store for consumption of alcohol off-premises (bar and restaurants are OK and not excluded)

Once you’ve decided to invest in a QOZ, planned for a Qualified Opportunity Fund (read more on that at our QOF Qualifications blog) and identified your investment property, it’s time to ensure you meet the improvement requirements.

The tangible business property must be acquired after 12/31/17 and either be original use property OR substantially improved by the taxpayer within 30 months. The “substantially improved” requirement is met by doubling the initial cost basis in the existing building.

Regulations are clear that only the building value needs to be doubled—the value of the land is excluded from the calculation.

How To Calculate Substantial Improvements In Qualified Opportunity Zones

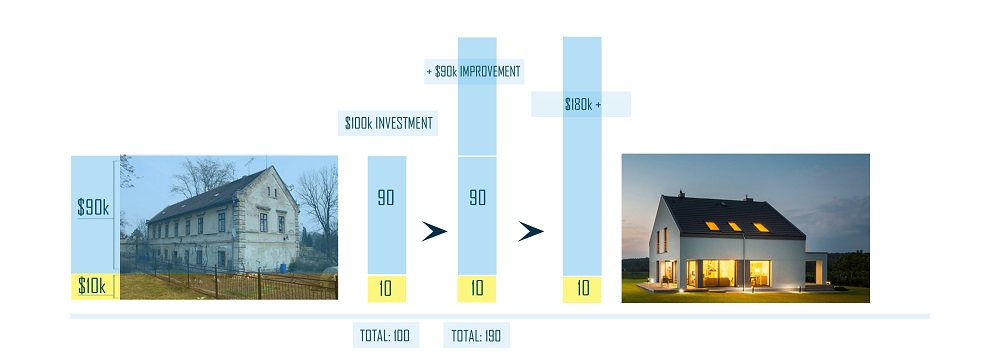

As you can see in the example chart below, you must separate the land value from the building value to get your initial cost basis. In this case, the property is worth $100k. $10k is reserved for the land cost and $90k is the value of the building. So, you must spend enough improving the property that the building ultimately is worth a minimum of $180k. Add back the original $10k land value for an overall property value of $190k (+).

Guidance Updates, April 2019

Guidance Updates, April 2019

We received additional clarifying guidance regarding eligible improvements in April 2019. These are the top of mind questions which were answered:

- Specifics regarding substantial improvement and original use for personal property – personal property does not need to be substantially improved as long as it has not been previously used within the zone. In other words, the QOF can purchase used equipment from an unrelated party and still meet the qualification of being “new” for purposes of meeting the 90% test as long as that piece of equipment has not previously been used within the opportunity zone. A potential workaround for avoiding the requirement to substantially improve an item of personal property that doesn’t qualify as “new” is by having the QOF lease the asset instead of purchasing it. A related party lease is also allowed within the rules for both real and personal property.

- Land improvements added after purchase to count towards improvement qualification – The regulations have clarified that unimproved or minimally improved land or an existing building acquired with its surrounding land are both not required to substantially improve the cost basis in land improvements. In these examples, any improvements added to the land such as parking lots, roads, fencing, and landscaping, will be treated as new property which counts toward meeting the 90% investment in the QOZ property test. These costs will not count toward the dollar amount of the improvements required to be added to an existing building, however.

Please call our office or email info@whhcpas.com if you have questions regarding QOZs, QOFs or are interested in these types of consulting projects. For more information see a video of our December 2018 recent seminar on QOZs here.

By: Ben Hubbell

By: Ben Hubbell