Qualified Opportunity Zones (QOZ) is a new benefit created with the new tax reform legislation and is one of the largest incentives to taxpayers that we’ve seen in a long time. Although fairly complex in terms of timing, they are simple to set up and maintain—absolutely worth the effort in terms of tax savings.

(View our one-hour seminar on this topic here)

The Purpose Of Qualified Opportunity Zones

The legislation around QOZs is clear about the goal to create economic growth and improve blighted areas. We’ve seen similar benefits like this (which center

on specific census tracks) but they have historically been less successful because of limited geography and the lack of a long-term strategy. QOZs require a longer and deeper commitment from the investor in order to make a real impact on the area, but they offer much greater tax savings. If you’re looking for tax savings on future investments with great appreciation potential—this is the vehicle for you.

on specific census tracks) but they have historically been less successful because of limited geography and the lack of a long-term strategy. QOZs require a longer and deeper commitment from the investor in order to make a real impact on the area, but they offer much greater tax savings. If you’re looking for tax savings on future investments with great appreciation potential—this is the vehicle for you.

Basics of Investing in Qualified Opportunity Zones

Boiled down into its most basic parts, these are the four phases of QOZ investment:

- Invest gain from a sale into a Qualified Opportunity Fund (QOF). This defers the tax on that gain for up to 7 years, with a 15% reduction in tax. The deferred taxable gain is not recognized until 2026 or until the asset is sold or exchanged—whichever happens first.

- The QOF then invests in new assets within the zones and significantly improves them.

- The taxpayer permanently avoids tax on any and all appreciation of the assets in the QOF, as long as it’s held for 10 years.

- There are several important deadlines surrounding the purchase and reinvestment date of assets. Be sure to consult an expert to ensure you meet the deadlines and maximize the potential benefit.

(Related post: Qualified Opportunity Fund Qualifications and Structures)

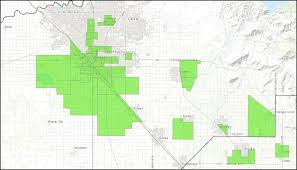

Where Are The Opportunity Zones In Fresno County?

California has the most available zones of any state in the US. (Click here to access an

interactive map of CA which shows all designated tracts by county.) Fresno County received its fair share of them, creating a huge opportunity for our investors and developers. The QOZs in Fresno include areas such as Blackstone corridor, Fresno State University’s campus, and the surrounding areas, farmland in nearby areas of Fowler and Kerman, etc. These are areas with marketable inventory that can reasonably meet the improvement requirements.

Other QOZ Benefits and Strategies

- Comparison to 1031 exchanges: Many investors who have relied on 1031s for tax deferral may begin using QOZ instead. Primarily because of the tax-free appreciation and also because they do not have the like-kind requirement.

- A 1031 exchange has to be like-kind. An investment in a QOZ does not, it just needs to be in a designated zone.

- To qualify for the benefits, the QOF must have 90% of its assets in the zones. However, specific partnership structures and strategies can overcome the 90% asset rule by creating subsidiaries, which are only required to hold 70%.

Contact Us

We will continue to publish details and strategies relating to QOZs and QOFs, but if we haven’t answered your question, contact us: info@whhcpas.com

By: Ben Hubbell

By: Ben Hubbell